Where the Anoka Conservation District Money Goes

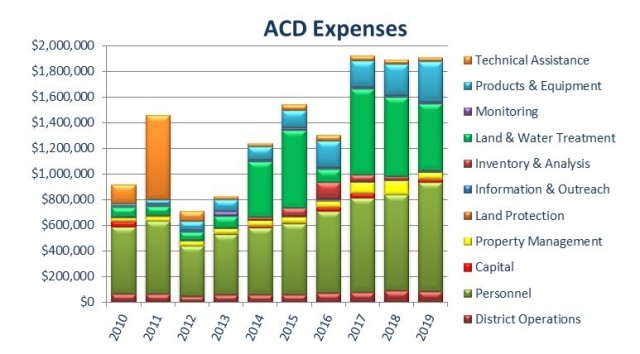

ACD finances historically experience dramatic variability from year to year due to activities being driven by competitive grants, several of which have been in excess of $400,000. Many state grants are from sales tax revenue dedicated to natural resource activities. ACD is committed to accessing these funds so Anoka County taxpayers will benefit from them in proportion to sales tax paid in the county. Also of note is how consistent ACD's operational and personnel costs have been. ACD staff and supervisors strive to keep overhead costs down, while expanding service

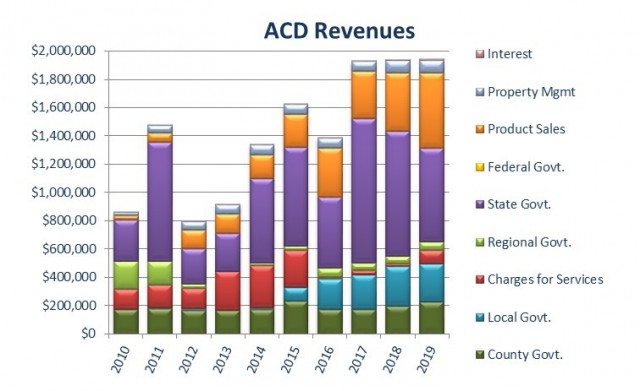

Making Sense of the Dollars: Although governed by an elected board, conservation districts do not yet have taxing authority and must secure funds from many sources to maintain programs and services. State grants are the primary funding source for project installation, while the county provides seven times what the state does to support general district operations. County funds are critical because many grants do not cover overhead expenses. Unfortunately, many grants also require matching funds, so county funds must serve as match and cover all costs ineligible under complex grant rules.

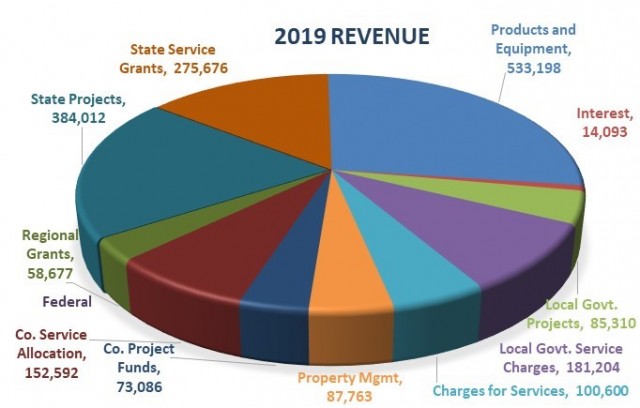

Making Dollars of the Cents: To provide comprehensive natural resource management, ACD collaborates with cities, watershed management entities, state agencies, county departments, non-profits, and landowners on projects of mutual interest. The 2019 revenue chart begins to convey this but does not show the 68 projects and programs supported by 26 distinct funding sources, many of which supported multiple projects and programs. For example, County Project Funds alone is comprised of 12 projects, and State Grants were used in part to fund 35 different initiatives